Consensus is an amazing thing.

Doing things because others do it can often be a poor excuse when it comes to common sense and also to breaches of the law of the land.

Dental computer software.

Dental computer software has its uses.

But there are components of dental software that are clearly invented by geeks and have no logical use in clinical practice, that have now crept in to the day to day way that dentists operate their businesses.

These activities are akin to the electric hand dryers we see in public bathrooms. They kind of seem like a good idea, but after using those drying machines, you still feel like you need to wipe your hands on a towel [or your trousers?] anyways….

Dental treatment room cabinetry.

I see dental practices with treatment rooms lined with cabinets upon cabinets upon cabinets.

Not only are these cabinets installed at the same cost as purchasing a three bedroom home [with a pool!!!], they act to magnetically attract all forms of junk and paraphernalia into them to justify their purchase… they are clutter magnets.

Capital gain or Ordinary income?

Lump sum arrangements received by dentists for supposedly operating as dentists within the confines of dental business owned by someone else are not to be treated as capital gains but are to be treated as assessable income according to section 6-5 of the Income Tax Assessment Act 1997.

Contractor? Who said that?

Just because someone tells you that you can be a “contractor” doesn’t mean that it’s an actual legal process.

And having a contract stating you are a “legal” contractor doesn’t mean a hoot if your role is deemed to be one of employee.

In just the same way that you cannot have a contract that legalizes bigamy, or murder, in lands where those actions are legislated against, you cannot be called a “contractor” if your conditions of engagement are defined by the tax office as being an arrangement between an employee and employer.

These sham contracts are usually suggested by companies seeking to gain an unfair competitive advantage in the marketplace.

These companies then rely on consensus to create an appearance of correct behaviour.

The Australian Tax Office is clear on this.

However, for some reason, your Dental Associations have tended to ignore the law.

This will change….

And when it does, those who have provided incorrect advice and also those who have avoided providing advice should be held accountable to their customers and members by class action.

*****

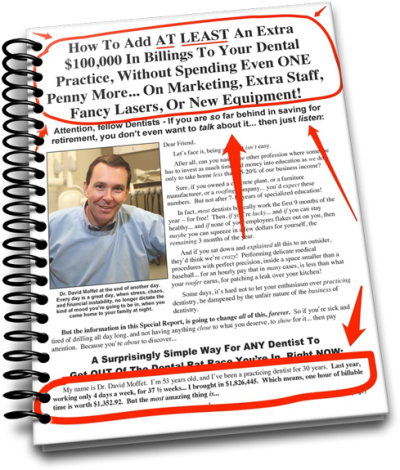

Have you read my book , How To Build The Dental Practice of Your Dreams [Without Killing Yourself!] In Less Than Sixty Days.

You can order your copy here: Click Link To Order

*****

The Ultimate Patient Experience is a simple to build complete Customer Service system in itself that I developed that allowed me to create an extraordinary dental office in an ordinary Sydney suburb. If you’d like to know more, ask me about my free special report.

Email me at david@theupe.com

Did you like this blog article? If you did then hit the share buttons below and share it with your friends and colleagues. Share it via email, Facebook and twitter!!